LVMH Sells Marc Jacobs: Where Next for a New York Giant?

The world of fashion, almost by definition, is one that’s subject to the prevailing winds of trends. However, 2025 has been a particularly tumultuous year for several brands that once seemed somewhat impervious to industry difficulties.

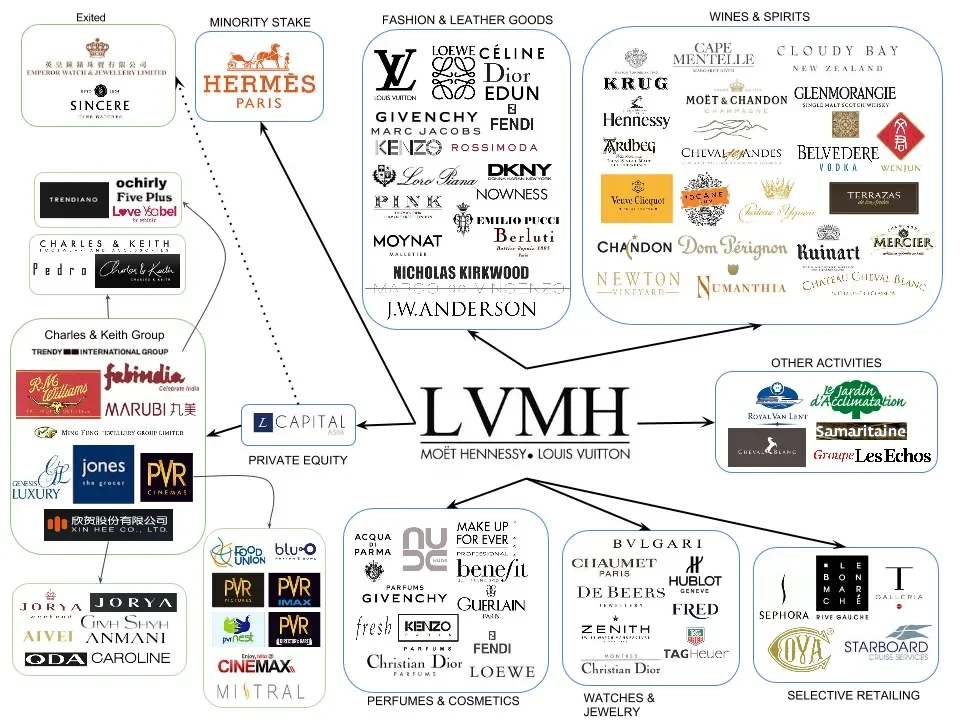

Topping off the list of troubled labels is fashion giant Marc Jacobs, which was recently announced as up for sale by French luxury powerhouse LVMH. Indeed, the heads of the fashion and luxury goods conglomerate have announced they no longer see a future for Marc Jacobs within their stable alongside Dior, Fendi, Bulgari, Louis Vuitton, Givenchy and several others.

Changing times for industry giants

The vast LVMH stable at its peak

At present, and completely understandably, the details of the Marc Jacobs sale remain firmly under wraps. However, certain whispers have inevitably risen to the fore - interested parties are said to be the Authentic Brands Group (within which we find Hunter, Juicy Couture, Vince and Barneys New York), as well as WHP and Bluestar Alliance. What’s immediately notable about these potential buyers is that they’re considerably different from LVMH when it comes to their portfolio - there’s a real emphasis on streetwear over luxury in their coterie - and yet they’re all supposedly willing to cross the one billion dollar mark in order to seal the deal.

The Marc Jacobs deal will eventually close, and it’s sure to have a real ripple effect across the fashion industry as a whole. However, it’s not the first major luxury deal to be finalised in 2025 - Prada acquired Versace from Capri Holdings in the Spring; an agreement that brought together two iconic Italian fashion houses that were once level-pegging in their successes in a sale that apparently topped an astonishing $1.4 billion.

There’s been plenty of speculation surrounding LVMH’s portfolio streamlining since last year, which has signalled real shifts in priority for the luxury conglomerate. The heads of LVMH have divested Off-White (the label launched to considerable fanfare by Virgil Abloh back in 2012) to Bluestar Alliance, and Stella McCartney bought back the minority stake in her brand from LVMH this year, too - a mere five years after it was first acquired with a host of plans and aspirations that never really got off the ground.

A reaction to rapid decline

The question must be asked: what does the Marc Jacobs sale mean for the luxury fashion industry as a whole? It’s certainly been a challenging few years for Marc Jacobs and several of its most comparable competitors, and the sale of the brand will come about against a fairly grim backdrop; one typified by a global drop in the luxury goods market, supposedly caused in no small part by economic and geopolitical uncertainty and the changing priorities of a new generation of wealthy individuals.

LVMH seem to be responding to this downturn by formulating a new era for their stable; one typified by a ‘super class’ of ultra high-end brands and producers. We’ve seen how Dior, for example, have raised their prices for the first collection from Jonathan Anderson - against such hotly-anticipated releases, Marc Jacobs looks increasingly irrelevant and out of place.

Essentially, the battle lines between street fashion and high fashion have once again been established, and the differences between these two worlds have become stark and distinct. DKNY (something of an equivalent to Marc Jacobs, in many ways) was sold off almost ten years ago for this very reason: it was deemed too accessible, too difficult to scale and too much like hard work when it came to turning big profits.

Where next for the once iconic brand?

When we bring these factors to the fore, the sale of Marc Jacobs begins to feel like a real inevitability - the brand tries to encompass too much, to be all things to all people. The result has been nothing less than confusion and inconsistency, with affordable street fashion and tote bags sitting alongside avant-garde runway shows and high fashion designs. The result? A brand that struggles with believability or justifiable value. There’s little doubt about Jacobs’ talent as a designer - his homecoming shows have long been a real highlight of New York Fashion Week - but in an attempt to be relatable, his brand ended up becoming diluted.

That’s not to say that it’s game over for Marc Jacobs - far from it, in fact. Certain aspects of the brand are doing very well indeed, and whoever buys the label will surely want to maximise upon what’s currently making money. With the dead weight removed, a new strategy implemented and careful consideration put towards legacy, it’s highly likely we’ll see an expansion of Jacobs’ perfume and eyewear in the new future - both of which have become flagship aspects to what the brand does best.